Are your in-house debt collection procedures streamlined?

Do you have a process to follow that helps keep your past due accounts to a minimum? If your in-house debt collection policies could you some fine-tuning, C2C Resources can help.

It’s not uncommon for the task of debt collections to be neglected in a business. For one thing, it’s not pleasant to make a collection call so calls often get put on the back burner. However, if you have the right tools at your disposal for making calls and sending notices, the task of managing your Accounts Receivables can be less painful and considerably more effective.

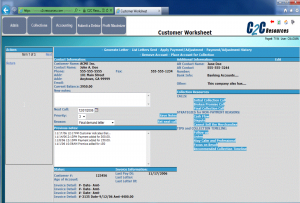

C2C Resources can help you manage collections in-house with its powerful Accounts Receivables management software system. Profit Maximizer is designed to help businesses keep track of the details throughout the debt collection process. It provides Contact Management, a detailed Reporting System, call scripts and collection notices that you can easily adapt for your needs. Simply fill in the blanks on the template and hit ‘send’.

C2C Resources can help you manage collections in-house with its powerful Accounts Receivables management software system. Profit Maximizer is designed to help businesses keep track of the details throughout the debt collection process. It provides Contact Management, a detailed Reporting System, call scripts and collection notices that you can easily adapt for your needs. Simply fill in the blanks on the template and hit ‘send’.

You can also sync with Quickbooks and input Excel spreadsheets with the click of a button.

As a partner, we provide our clients with everything they will need to manage accounts receivables in-house through our Profit Maximizer program. And there’s no extra cost to use this web-based program! When you partner with us, Profit Maximizer is yours and we offer support as you learn the system.

Experience the difference with Profit Maximizer! Check it out at C2C Resources.

When you call your past due customer, it’s quite likely that yours is not the only collection call he’s taken that day. In fact, he may be staring at a stack of bills an inch thick while on the phone with another creditor right now!

When you call your past due customer, it’s quite likely that yours is not the only collection call he’s taken that day. In fact, he may be staring at a stack of bills an inch thick while on the phone with another creditor right now!